Central Bank Digital Currencies (CBDCs) have emerged as a groundbreaking innovation, captivating the attention of governments– financial institutions, and technology enthusiasts alike- As we step into 2024, the concept of CBDCs is becoming more tangible, with several European countries, including the UK and Sweden, taking significant strides towards integrating these digital currencies into their financial systems. This shift aims to enhance security and efficiency, making the dream of a fully digital economy closer to reality. Let’s dive into what CBDCs are, why they’re important, and how blockchain technology plays a crucial role in their development.

What are Central Bank Digital Currencies (CBDCs)?

CBDCs are digital forms of a country’s fiat currency, issued and regulated by the nation’s central bank. Unlike cryptocurrencies such as Bitcoin or Ethereum, which operate on decentralized networks, CBDCs are centralized and controlled by the central bank, ensuring stability and trust. Essentially, a CBDC would function as a digital version of the physical cash we use today, but with added benefits tailored for the digital age(Read more:The Use of AI Technology: Utilizing AI in Financial Data Analysis, Fraud Detection, and Investment Management)

Why are CBDCs Gaining Attention?

The rise of CBDCs is driven by several factors, each pointing to a more secure and efficient financial ecosystem.

- Enhanced Security: Traditional cash transactions can be susceptible to theft, loss, and counterfeiting. Digital currencies, on the other hand, can leverage advanced encryption techniques to provide a higher level of security.

- Financial Inclusion: CBDCs have the potential to bring financial services to unbanked and underbanked populations, offering them access to the digital economy through just a mobile device.

- Efficiency in Payments: Digital currencies can streamline transactions, reducing the need for intermediaries and cutting down on transaction times and costs. This efficiency is particularly beneficial for cross-border payments, which are often slow and expensive.

- Economic Stability: By maintaining control over a digital currency, central banks can better monitor and manage economic activity, implementing monetary policies more effectively.

- Combating Illegal Activities: The traceability of digital transactions can help authorities combat money laundering, tax evasion, and other illicit activities more effectively than with cash.

The Role of Blockchain Technology

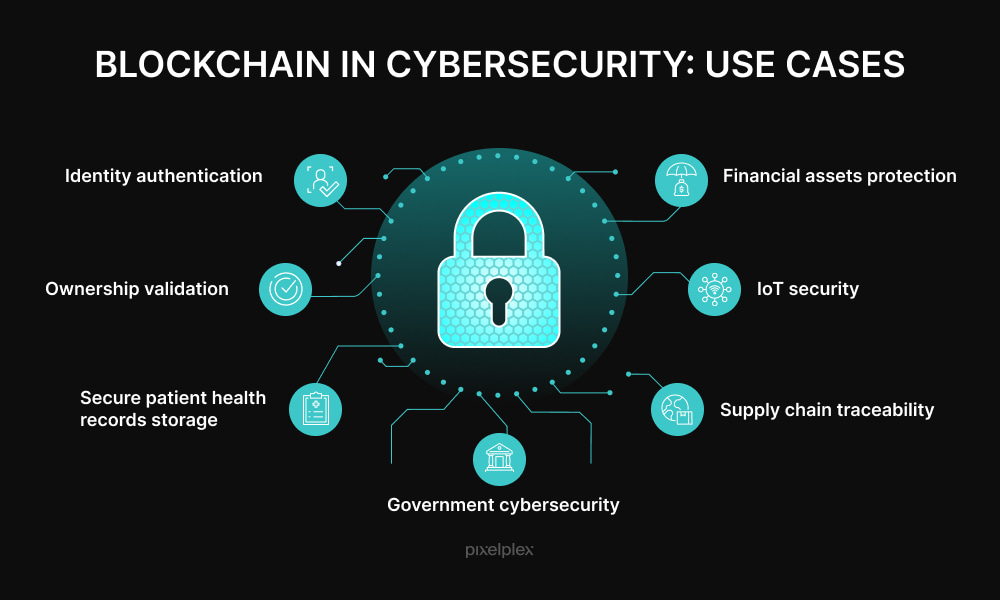

One of the key technologies underpinning CBDCs is blockchain. Blockchain, a type of distributed ledger technology, provides a secure, transparent, and tamper-proof record of transactions. Here’s how it supports the development and functionality of CBDCs:

- Transparency and Traceability: Blockchain records every transaction in a public ledger, which can be viewed and verified by all participants. This transparency reduces the risk of fraud and enhances trust in the financial system.

- Security: The decentralized nature of blockchain means that there is no single point of failure. Transactions are encrypted and distributed across a network of nodes, making it extremely difficult for hackers to alter the data.

- Efficiency: Blockchain can automate many aspects of transaction processing through smart contracts, which are self-executing contracts with the terms directly written into code. This automation reduces the need for manual intervention, speeding up processes and lowering costs.

- Interoperability: Blockchain’s standardized protocols can facilitate seamless integration with other digital systems, enhancing the overall efficiency of financial services.

European Countries Leading the Way

Several European countries are at the forefront of exploring and implementing CBDCs, with the UK and Sweden being notable examples.

The UK

The UK has been proactive in researching and testing the potential of CBDCs. The Bank of England has initiated several projects to understand the implications of a digital pound. These projects focus on ensuring that a CBDC would be resilient, secure, and efficient, while also maintaining the integrity and stability of the broader financial system. The UK’s approach is characterized by a commitment to innovation and collaboration with various stakeholders, including technology companies, financial institutions, and the public.

Sweden

Sweden is another pioneer in the CBDC space. The country has been experimenting with the e-krona, a digital version of its national currency. The Riksbank, Sweden’s central bank, has conducted extensive pilot programs to evaluate the feasibility and functionality of the e-krona. The aim is to create a digital currency that complements cash, offering a reliable and secure alternative for payments. Sweden’s push towards a cashless society makes it an ideal candidate for CBDC adoption, as the population is already accustomed to digital payments.

Challenges and Considerations

While the benefits of CBDCs are clear, their implementation is not without challenges. Here are a few considerations that central banks must address:

- Privacy Concerns: Balancing the need for transparency with individuals’ right to privacy is crucial. Central banks must ensure that CBDCs do not become tools for excessive surveillance.

- Technological Infrastructure: Developing and maintaining the technological infrastructure required for CBDCs is a complex task that demands significant investment and expertise.

- Regulatory Framework: Establishing a robust regulatory framework that can adapt to the evolving nature of digital currencies is essential to ensure stability and security.

- Public Trust and Acceptance: Gaining public trust and acceptance is vital for the success of CBDCs. Central banks must engage with the public to educate them about the benefits and address any concerns they may have.

The Future of Money

As we look ahead, it’s clear that CBDCs have the potential to revolutionize the way we think about money and payments. By harnessing the power of blockchain technology, CBDCs can offer a secure, efficient, and inclusive alternative to traditional cash. The efforts of countries like the UK and Sweden provide valuable insights and pave the way for others to follow. While challenges remain, the momentum behind CBDCs suggests that they could soon become a fundamental part of our financial landscape.

In conclusion, Central Bank Digital Currencies represent a significant step forward in the evolution of money. With the promise of enhanced security, efficiency, and financial inclusion, CBDCs are poised to reshape the future of finance. As we move into 2024, the exploration and implementation of these digital currencies will undoubtedly be a topic of great interest and importance, marking the dawn of a new era in the world of digital money.

Read more:Blockchain Interoperability: Connecting the Dots in Blockchain Technology 2024